When my children’s swing set arrived, it was a collection of wood, screws, rope and plastic. Not fun at all, but when built it was a different story.

The same principle can be applied to building an investment portfolio. The building blocks on their own can swing between looking disappointing and incredible, but it’s what they do when blended together that provides the ‘magic’.

Investing vs speculation

Firstly, let’s define exactly what we mean when we talk about investing. There is a common image of investors buying and selling today’s hot stocks and funds to time the market and beat their competitors. I would define this as speculation.What we do at Clear Vision Financial Planning is different. Our goal is to build and manage a portfolio that will deliver the return needed to give our clients the future they want; all whilst managing the risk involved and making sure that we don’t suffer catastrophic falls that can’t be recovered from.

In other words maximising the chances of our clients meeting their immediate and future life goals; and minimising the chance of failure.

Returns are unpredictable

When we bear this in mind, it becomes incredibly important that we don’t expose our clients to a market that might go into a tailspin. However, how easy is it to predict? Let’s look at some data…

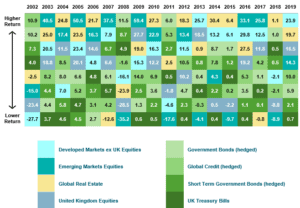

The above chart looks at the returns of different asset classes in recent history. Anything on the top line was the best performing asset class in that year, whilst anything on the bottom line was the worst. As you can see, there is no real pattern to the returns. We have years where the top performer can fall to the bottom and vice versa.

For example, in 2006, global real estate topped the asset classes with returns of 21.7%. In 2007, that same asset class was the worst performer with a loss of 12.6%. In 2015, emerging markets lost 9.7%, however, in 2016 and 2017 the returns were 33.1% and 25.8% respectively.

Picking which asset class will be the best performer is a mugs game. However, if we blend the asset classes together we can get a more stable return.

The seesaw effect

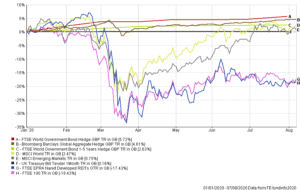

Blending the asset classes together can seem counter intuitive. The reason for this? There is always a disappointing performing asset class. Every single year, there will be an asset class that is disappointing. Last year it was UK Treasury Bills, Short Term Government Bonds and Government Bonds. At the time, it may have seemed like these asset classes were holding portfolios back.The below chart shows how each of these asset classes has behaved so far this calendar year. As you can see, at this point in 2020, these ‘disappointing’ asset classes have been the most stable and dampened a lot of the losses we saw from other asset classes at the start of the pandemic.

When we build portfolios for our clients, we are looking to incorporate diversification to deliver a better investment journey that maximises the chances of success. We can’t eradicate risk, but we can manage it. Diversification is a key component of this.

Summary

By blending defensive asset classes with growth based asset classes, we can diversify our clients portfolios and ensure that they aren’t tied to the fortunes of any one company, country or asset class. If we’re doing our job correctly, there will be always be a part of the portfolio that is disappointing. However, that very same asset class may be the saviour next year.At the moment, equity markets are the disappointment. But in the same way that bonds are the hero of today (after being the disappointment of 2019), stock markets may be the heroes of tomorrow. The key is, no-one knows who will win the battle for next year. We have to stay diversified and stay disciplined to maximise the chances of success.

Production

Production