The old enemy has risen it’s ugly head!

No, I’m not talking about football rivalries, I’m talking about inflation. The Office for National Statistics (ONS) announced that the Consumer Prices Index (CPI) rose by 2.4% in the 12 months to the end of June 2021. This is an increase of 0.8% in two months.

In terms of the severity, this is a fairly big jump. However, there are arguments about whether this jump is due to the post lockdown recovery or an early warning sign of inflation running out of control.

What is inflation?

Inflation is the measurement of the rate at which prices are rising. For example, if something costs £1 and rises to £1.02, the inflation rate for that item is 2%.

The ONS measures inflation using a basket of goods and services which they constantly tweak to try and reflect the spending habits of the population. For instance, hand sanitiser has now been included in the basket of goods, reflecting that it has become a more common item to buy.

Why is high inflation so dangerous

In financial planning, inflation is one of the biggest risks we face, but why is that?

When we talk about figures of 2.1%, it doesn’t seem too bad. In the last 10 years, inflation has averaged 2.7% pa (source: ONS). This means that something which cost £100 in 2010, now costs £131.13. Let’s go back further, what about the last 30 years? Something that cost £100 in 1990 would now cost £232.44 (average inflation of 2.9%). That’s quite a rise!

Let’s put this into a real life example. In 1990, a first class stamp cost 22p. Today a first class stamp costs 85p. This is a rise of 386%!

This slow creep in the cost of lifestyle can be barely noticeable from year to year, but will add up to huge rises over time. Over a 30 year retirement, this can be catastrophic if you don’t own assets that keep up with inflation.

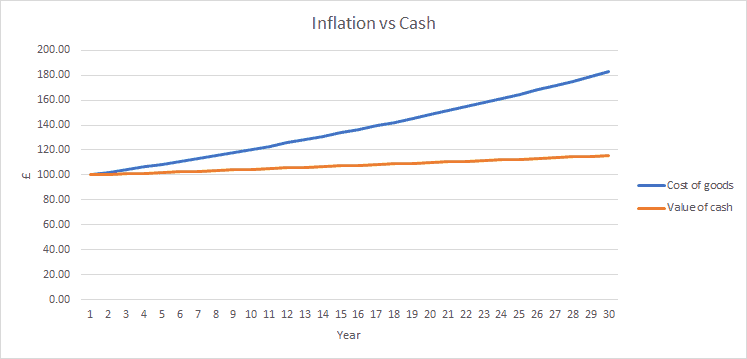

When we combine the inflation figure of 2.1% with the current interest rate of 0.5% that’s available and extrapolate it out; you can see that over a 30 year period the cash account loses value against inflation. In fact, in 30 years, the cash is only able to buy 63% of the goods it could at the beginning of the period. This is a sure fire way to run out of money!

What does this mean for you?

This means that one of the keys to your financial plan needs to be to own income streams and assets that keep pace with, or beat inflation. The state pension and most final salary schemes have incomes that are designed to provide an element of inflation proofing. But what about your capital?

Historically, stock markets have done a great job of delivering investors with returns above inflation. Over the last 20 years, global stock markets (source: MSCI Global index) have grown at an average of 7.63% pa and provided inflation beating returns.

However, the fact that stock markets have outperformed inflation in the past is no guarantee that they will do in the future (risk warning: past performance is no guide to the future).

It’s also worth bearing in mind that higher expected return leads to higher risk and, at times, a bumpy ride. The higher exposure to the stock market, the more exposed your assets are to stock market shocks.

To counteract this, we blend a globally diversified portfolio of stock market assets with more defensive, stable assets. This lowers the expected long-term return, but also lowers the volatility; providing a portfolio that targets the inflation beating growth that our clients need, whilst protecting their ability to sleep at night when markets get rough.

A strategy to combat the effects of inflation on your financial plan is essential to be successful when planning for the long-term. That’s why we focus on this so much.

As always, if you know of anyone that would benefit from our services, please pass our details on. I’m always happy to have an initial chat to see if we can add value.

Production

Production