Before we get into this blog, I’d like to say how sad we are at the passing of Her Majesty the Queen. Our condolences go out to the Royal Family at this time. The office will be closed on Monday 19 September as a mark of respect.

If the news is to be believed, things are looking pretty bleak. We are facing high inflation, recession is looming, and Russia is likely to try and squeeze us more as Winter sets in.

I’m not denying any of these things, but let’s try and balance the discussion slightly and find some positives…

Inflation

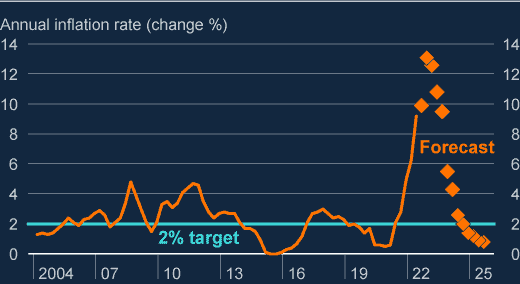

Below is the latest (August 2022) inflation forecast from the Bank of England (BOE). Now, regular readers will know that I’m not a fan of relying on forecasts, but it gives us a bit of an insight when faced with extreme inflation.

As you can see, the expectation is that inflation will rise further, peaking at the end of 2022/start of 2023. The forecast is that inflation will then fall sharply to the 2% target in two years’ time and well below in three years’ time (source: Bank of England, 2022).

I have no idea if this will turn out correct, but even if the general shape is correct, the future starts to look brighter when balanced against the doom and gloom being peddled by the news industry.

Recession

Is recession something to worry about? I’m not going to downplay recession, it’s hard. But when reading about recession, it’s important to remember that the economy does not equal the stock market.

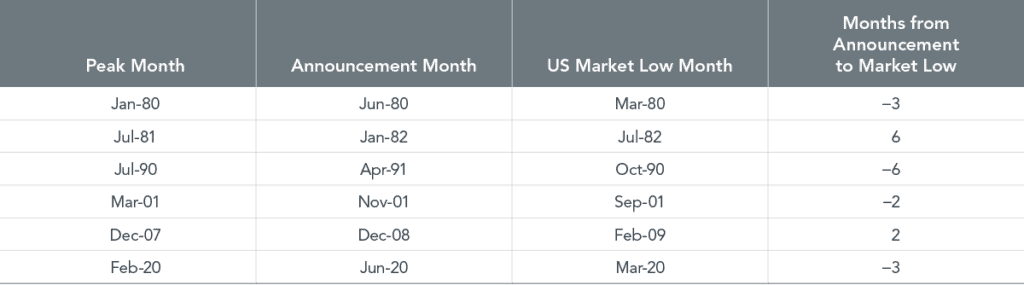

Recessions are defined by certain indicators such as employment and growth of GDP. These are all measured after the event. As such, by the time a recission is announced, stock markets are often on their way towards a recovery (source: Dimensional 2022).

Economic outlook

Vanguard have recently released their mid-year economic outlook. Their assessment is that the risk of recession has increased. This is due to the cooling effects of actions from central banks to combat inflation. They have also downgraded their economic growth forecasts for the major regions.

However, they are expecting improved long-term returns. As stock markets are sitting at lower equity valuations and interest rates are rising, their model suggests higher expected long-term returns for most global markets. In fact, their 10-year forecasts have risen by c1.0% for equity markets and c1.5% for bond markets. Again, these are all forecasts, but show a different side to the equation.

This is why jumping out of markets in downturns is counter intuitive.

UK Bull vs Bear Markets

Timeline produce a series of charts each year that are useful in looking at the historical behavior of markets. This year, the chart looking at bull and bear markets in the UK has been very useful.

In this data set, they look at the length and depth of each bull and bear market from January 1926, up to December 2021. It’s very interesting reading and shows that the average bull market lasts 7 years and has an average return of 508%. The average bear market lasts 18 months and leads to falls of 35% (source: Timelineapp Tech Limited, 2022).

The lessons from this are clear, although painful, bear markets tend to be short lived in comparison to bull markets.

Summary

The current climate does look grim, but there are definite positives including…

- Inflation is high but is expected to drop back in the short to medium term.

- A recession announcement does not automatically mean poor stock market performance.

- Recent stock market falls and interest rate rises have improved the long-term outlook for investments.

- Bear markets last significantly shorter than bull markets and fall significantly less in comparison.

None of this makes it any less painful or scary, but perhaps helps with managing emotions and counterbalancing the negativity that is out in the news currently. As ever, it’s important to point out that past performance is no guide to the future.

As always, if you have any questions, please do let me know.

Production

Production