If ever we needed a reminder of the fickleness of markets, last year provided it. The reason investing provides a greater return than cash is the presence of risk. For every few steps forward, there is a step backwards. This can feel painful, but if investing was easy, there would be no reward.

In 2022 we faced soaring inflation, rapidly increasing interest rates, a challenging political environment and a war in Eastern Europe. This led to a pull back in stock markets and the worst year on record for bond markets.

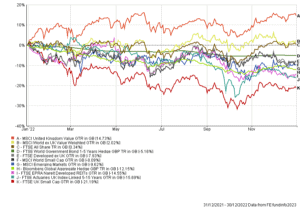

Asset class returns

The below chart shows the returns for the calendar year to 31st December 2022. Stock markets globally struggled. The exception being global developed value companies. Bond markets were hit by rising yields across the globe pushing capital values down. The UK especially suffered from the double whammy of rising interest rates and falling political confidence in the Autumn. Short term bonds provided a level of protection, but were still down.

Unfortunately, this means most investors finished 2022 in a negative position. However, our exposure to value companies and short term bonds managed to soften the fall.

It could be worse…

There were some areas that performed significantly worse. Crypto had an awful year as did some NFT’s with huge falls and some instances of 100% losses as investments collapsed. Large US tech companies such as Facebook (-66.00%), Amazon (-51.00%), Tesla (-65.00%) and Microsoft (-28.09%) had a dire year as did some of the ‘hot stocks’ of recent times such as GameStop (-51.69%).

3 things to remember

Should you worry? In a word, no.

This can be a worrying environment, but is completely natural and is built into our return assumptions for your financial plan. The key here is to ensure we limit the falls through global asset class diversification and avoid making bad decisions.

The focus is on ensuring you remain diversified to spread the risk and position you to benefit from any recovery. Those damaging higher yields in bonds, which pushed capital values down, will translate to higher future interest payments and mean that the future expected return for bonds has risen.

Investing is never easy, but years like 2022 are sent to test the nerves. As such, here are 3 things to remember…

1. A planning led investment strategy with a focus on a robust, globally diversified portfolio is best placed to weather the storm and be ready for any recovery. The financial plan should always dictate the investment approach.

2. The market will have years where it goes up and years where it goes down. Overall, the up years outnumber (and make up for) the down years. At the same time, the start and end of a recession doesn’t tend to correlate with stock market movements.

3. When the market recovers, it tends to do so quickly. We don’t know when bear markets cease and the recovery starts, but we do know the recovery tends to be quick.

As ever, the key is to refer to your financial plan, remain invested, heavily diversified and trust the process. Markets will have periods of time where they deliver negative returns. However, they are still the best long-term defense against inflation.

Note: Past performance is no guide to future performance.

Production

Production