With everything that’s going on in the world, it can be tempting to want to take action. As such, I felt like now was a good time to let you know my thoughts on what you can do, what you shouldn’t do and some tips on general wellbeing.

What shouldn’t you do

The investment world is a scary place to be right now. Markets have tumbled in recent weeks and they still look very nervous. However, this is a general feature of markets. It may look and feel different, but this decline is very much within the range of historical scenarios.

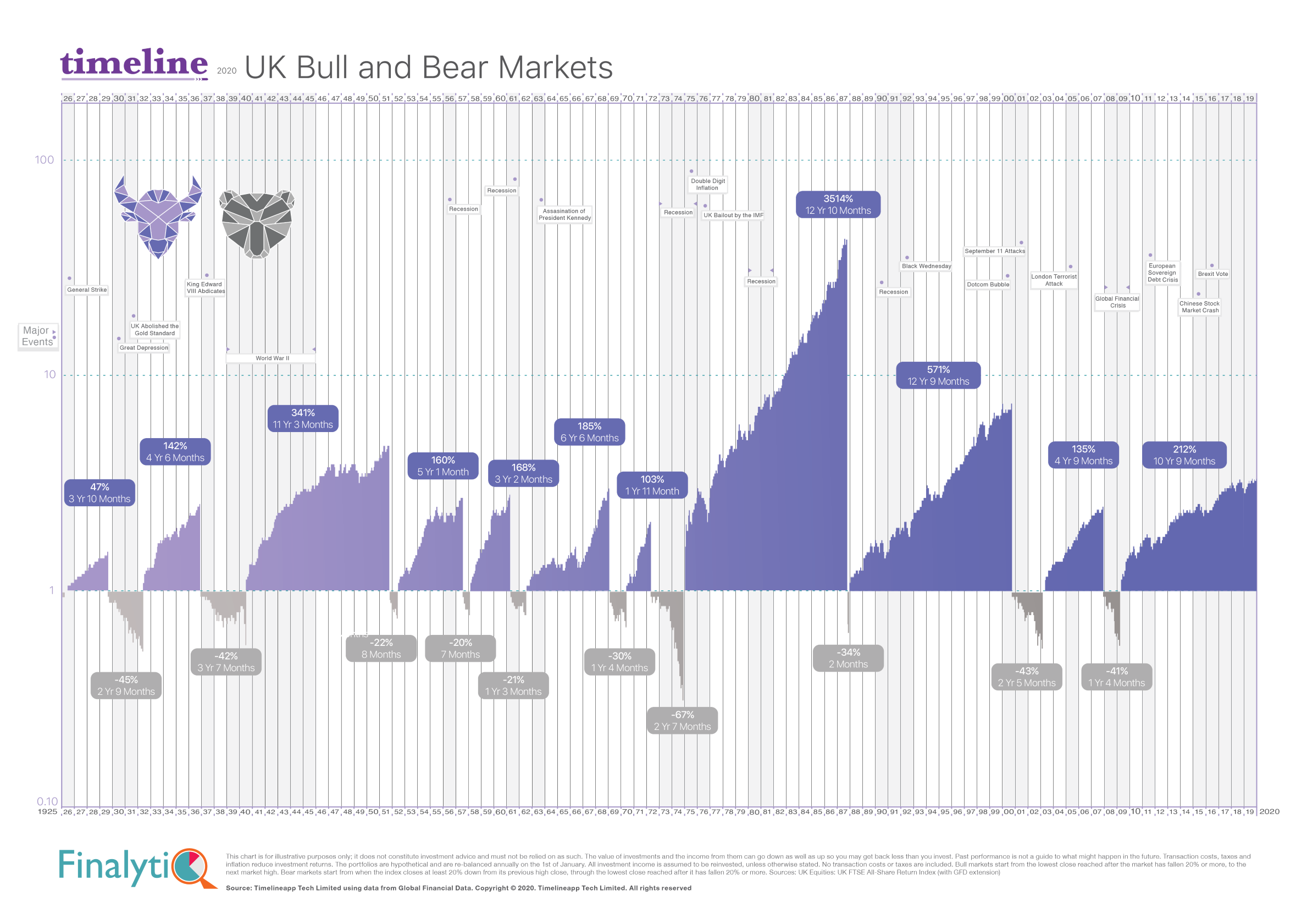

If we look at the below chart (thanks to the guys at Finalytiq for producing this!), you can see that ‘bear’ markets of the past have ranged from a full drop of 20% to 67%. The average ‘bear’ market for the UK lasts 20 months and bottomed out after a 37% drop. You can also see that immediately after a ‘bear’ market, the corresponding ‘bull’ market tends to be larger. This is no indication for future (it may be shorter/longer/better/worse), but it does give us some historical perspective.

This is the reason we have stress tested our clients financial plans over and over to ensure it can withstand these shocks. Not only that, but we have modelled and talked about what (if any) actions they should take if there are unprecedented drops in the stock markets (without recovery).

The worst thing you could do right now is to sell to cash. But why is that?

Long-term investments will go up and down. One of our main investment beliefs is that risk and return are related. You cannot get a return without taking risk. The volatility experienced (i.e. the up and down movements in the stock market) is part of that risk. This means that the return you earn over the long-term is the reward for taking the risk of a temporary drop in markets.

One of the arguments I have heard put forward is that it is possible to jump out of investments into cash when stock markets turn red (to protect against the downturn) and jump back in when things are looking better (to participate in the reward). In fact, I know of at least one IFA who has done this (after the markets dropped).

The issue with this is you have to get two impossible decisions correct. Firstly, when to jump out, and then, secondly, when to jump back in. No-one knows which way markets are heading until it’s too late. This strategy is the equivalent of taking a bet and hoping to get lucky. We don’t want our client strategies to be built on luck!

This is why we recommend keeping a decent amount in cash (for emergencies) and having a good percentage (depending on your risk profile) in defensive bond holdings. This tempers the volatility of the stock markets and ensures our clients have the least chance of needing to encash when the markets are at the bottom.

This is not the time to make drastic changes to your investment strategy. Your financial plan and investment strategy was designed to weather storms like this. As Warren Buffet says:

“The stock market is a device for transferring money from the impatient to the patient”.

What can you do

As I say that the best thing to do is nothing, I recognise that for some, this may prove difficult. The key here is to focus on what you can control (and stock markets are not one of those things). Whilst there is nothing you should do for long-term holdings, there are things you can do to tidy up your finances and prepare them for if this situation does drag on. Here are some suggestions…

- Review direct debits – With lots of people having spare time, a review of direct debits can be useful to reduce outgoings. If you haven’t negotiated with Sky, your utilities companies or your insurance companies, think about doing this. Websites like USwitch can be great for this.

- Reduce discretionary spending – If you are worried about income, it may be comforting to consider reducing discretionary spending in the short term, where possible. With advice against going to pubs and restaurants, this may be easier than at other times.

- Emergency cash buffer – With all of our clients, we have encouraged holding an emergency fund of liquid cash. If you begin to struggle financially, this is what it’s there for.

- Wills and LPA’s – If I’ve been nagging you to get these sorted, it may be a good time to get these kind of things in order. If you need an introduction to a good solicitor, please let me know.

- Call us – If you’re still worried, call us! I’m happy to listen to your worries and concerns and offer any thoughts, advice or guidance (or just a sympathetic ear) where possible.

Wellbeing

The coverage in the media (both traditional and social) can be scary and alarming. At times like these, it is essential to look after your physical and mental wellbeing to stop this turning into fear and depression. A few tips for this are…

- Eat well and stay hydrated – Make sure you eat a good balanced diet to keep your blood sugar stable, and make sure you drink enough water.

- Get fresh air – Social distancing doesn’t mean not going out. It just means not putting yourself in situations with lots of contact with other people. Unless you are self-isolating, you can still go for a walk, jog, bike ride, etc. If you are self isolating, find a way to get fresh air. Open the window, get in the garden, get natural sunlight, etc. Here is the NHS guidance on social distancing.

- Stay stimulated – spend time doing things you enjoy! Play board games, read, cook, play music, watch films, sing, dance, exercise, do yoga, learn a language, etc. Youtube can be a great place to find routines that can be done in your home. Keep yourself mentally and physically stimulated.

- Don’t listen to the media – Turn off the news, the media is not your friend! Instead, get your information from the NHS and follow their guidance. The dedicated page is here.

For now, our clients should be confident that their investment portfolio is built with their financial plan at heart. When building a financial plan (and subsequent investment portfolio) we have modelled extreme market conditions and built a plan that is based on empirical academic evidence. We are by your side to help you get through this.

Please stay safe, stay positive, practice social distancing where possible and wash your hands often (here is the NHS guidance on hand washing). Feel free to get in touch at any time.

Production

Production