When markets swing wildly, it can make investors nervous. Watching your investments decline can cause feelings of panic and despair. These feelings are completely natural, but should be largely ignored. Why? Because volatility isn’t something to be feared.

It’s natural

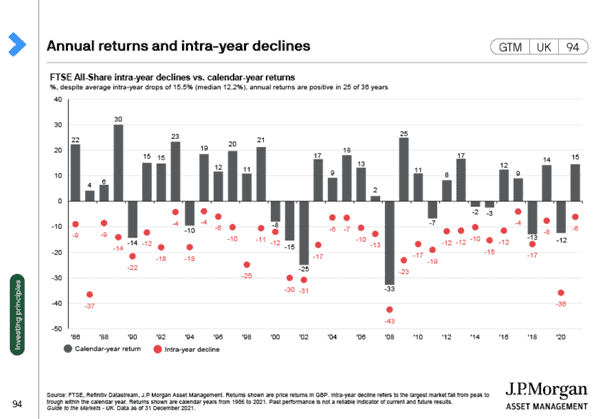

Market volatility is always a shock, but shouldn’t be. Volatility is more common than you think. The below chart is taken from JP Morgan’s Guide to the Markets Report (2021). It shows the returns of the FTSE All-Share for each calendar year, alongside the declines that happened in each of those years.

Points to be taken from this are..

- Every single year has had drops in the middle of the year. The average intra-year drop is 15.5%.

- Despite this, markets have been largely positive with 25 out of 36 years showing a positive return.

- It’s impossible to judge the overall calendar year return based on the size of the drop. For example, 1987 had the second largest intra-year decline (-37%) but still ended the year with a positive return of 4%.

Whilst there is no guarantee that what has happened in the past will happen again in the future, this shows that markets have periods of decline every single year, even in good years. The only time it becomes a problem is if we bail out of the market during a decline and miss the subsequent bounce.

Lack of volatility is a worry

Why can’t we find an investment that has returns but low volatility? This is the ‘holy grail’ of the investment world.

One of our key investment principles is that risk and return are linked. You cannot get a return without the volatility. If someone says you can, be very sceptical! There are many examples of fraudulent investment schemes marketing ‘smooth’ returns without volatility that have led to catastrophic losses for the investors. Examples include Bernie Madoff, Arch Cru and London Capital & Finance.

The real fear

What’s the real fear of volatility? My belief is that the real fear is that the markets will keep declining and lose all value. The reality is that this fear only exists if you are invested in a single company or a small collection of companies. They can (and do) go under all the the time, reducing the value of the shares to zero.

However, by diversifying widely across the world, we can reduce this risk. One of the funds within our client portfolios is the Vanguard Developed World ex-UK Equity Index fund. This fund invests in companies across the world. The current number of companies it invests in is 2,116 (source: Vanguard, 7 March 2022). This helps protect against the risk you are exposed to if one or two of those companies fails.

In summary, although market volatility is uncomfortable, it is normal. We do try to reduce volatility to levels you can live with using defensive assets. We also use diversification heavily to reduce the risk of total loss. However, volatility is the price you pay to gain the long-term returns of the stock market.

Production

Production