Happy New Year! I hope you had a lovely Christmas break.

Well, what a strange year 2020 was! 2021 has continued in a similar vein with another lockdown being announced in the UK. Alongside the events on Capitol Hill in the US, it frequently feels like we are living in a disaster movie!

Firstly, I’d like to reassure you that we continue to be fully operational. The office is physically closed to clients, however, we are still utilising technology to continue delivering our financial planning service. All meetings are being held via Zoom with minimal disruption and all post is being collected from the office.

A brief look back

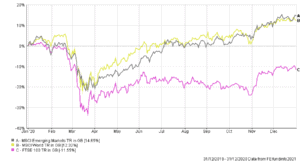

It’s been a rollercoaster of a year for stock markets with the FTSE especially hitting new lows. Global stock markets have recovered well with the FTSE lagging slightly.

However, it’s been very heartening to watch how our client portfolios have performed during 2020. They did drop in March (when stock markets went into freefall), but the defensive assets did a great job in reducing the effect that the stock market volatility had on the portfolio values. Since then, the portfolios have all recovered and are showing positive gains for the year. We kept all of our clients invested throughout and all financial plans remained on track throughout the year.

In terms of our business, we have continued to grow steadily and are in a strong and stable financial position. We decided to pause on adding a new staff member, however, we did add a new outsourced technical person to enhance the service we are delivering.

Looking back on the year from a non-financial perspective was an interesting experience. We’ve all lived it, but it’s worth reiterating that we’ve had…

- A fast moving global pandemic

- Lockdowns

- Empty shelves in supermarkets – no toilet roll, canned goods, pasta, soap, etc.

- Deserted roads

- Businesses shut

- Staff on furlough

- Thursday night clapping for the NHS

- Online pub quizzes

- Zoom family gatherings

- Facemasks

- Brexit

- Lorry queues at Dover

- Flooding

The year ahead

As with any year, it is impossible to predict what markets will do over the next 12 months. One thing is for certain, there will be good times and bad. Our job will be to manage the risks our clients are exposed and ensure that their financial plans and investment portfolios are managed efficiently and in support of the life they want to live.With vaccines being rolled out, I am hopeful that life will return to some form of normality. I worry less about the financial markets, and more about the survival of small businesses, those in the leisure, entertainment and hospitality sector and the mental health impacts of all the lockdowns.

Clear Vision in 2021

What about us?I feel quite positive about the coming year! We are focused on continuing to build our business in the right way, with a focus on quality and value. We will continue trying to deliver a valuable client experience for our clients and finding ways to ensure our clients are making smart decisions with their money. One of the areas we will be reviewing is our client reporting to establish if we can improve on the output we issue to our clients.

For those of you who have referred friends and family to us in the last 12 months, I’d like to give a huge thank you for trusting us enough to introduce us. It means a lot to me. We will be looking to help a number of new client families this coming year. With this in mind, we want to make sure that potential clients can get a good picture of how we work. Part of this process is collecting reviews from existing clients. We will be sending this request out separately and I would very much appreciate any time you can spare to provide a review.

Whatever the next 12 months has instore, we will be here to support, guide, encourage and work in partnership with our clients to ensure they remain able to live the life they want without any money worries.

Production

Production